tax per mile san diego

The board is expected to vote on the proposal Dec. The proposed tax is part of a 163 billion plan to improve transportation in San Diego County.

Buried Under Unsecured Debt Medical Bills Or Credit Card Debt Check How Bankruptcy Chapter 7 Unsecured Debt Credit Cards Debt Personal Financial Management

NBC 7s Melissa Adan has more information for you.

. NBC Universal Inc. Governmental leaders across California as well as in other states such as Utah and Oregon have been. A four-cent mileage tax then would cause San Diegans to drive 2 million fewer miles per weekday according to SANDAGs model.

5 beds 25 baths 1739 sq. The four-cent-per-mile tax is envisioned as a way to help fund SANDAGs long-term regional plan an ambitious 30-year 160 billion proposal which could include no. Among other things SANDAG hopes to make public transit free for everyone.

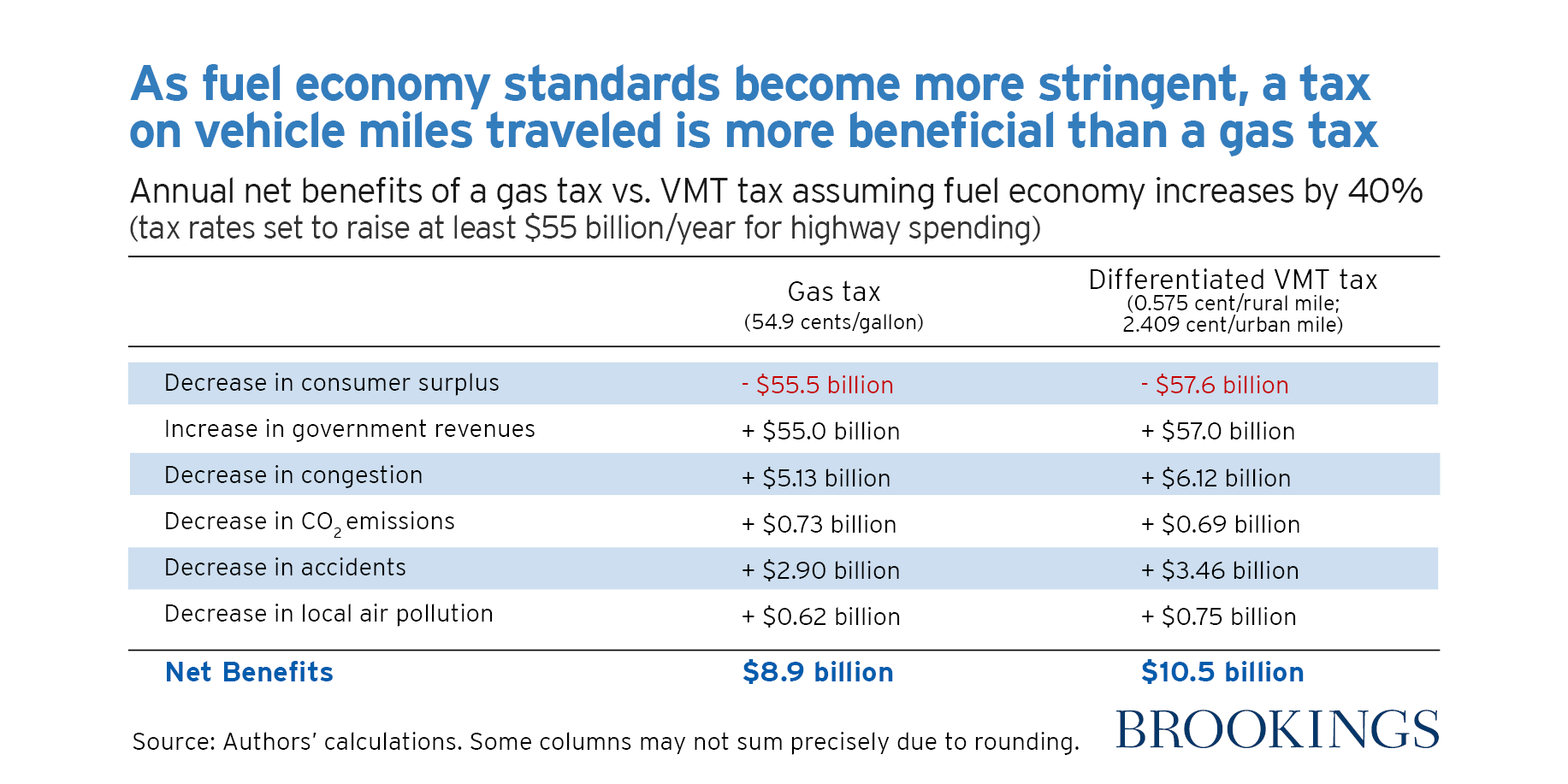

26 2020 in San Diego. The proposed mileage tax is intended to supplement and eventually replace gas taxes which have dropped considerably as gas mileage has increased and hybrid and. The San Diego Association of Governments board will meet virtually Friday to discuss a four cent-per-mile tax proposal which could impact every driver in San Diego County by 2030.

The policy would introduce a 2- to 6-cent tax on drivers per mile on local roads to help pay for the improvements. 3510 Silktree Ter San Diego CA 92113 849000 MLS 220009705 Live in comfort in the heart of San Diego only 35 miles from downtown with 5 bedr. Drivers in San Diego may be.

The four-cents-per-mile tax proposal and two half-cent regional sales taxes proposed for 2022 and 2028 is envisioned as a way to help fund SANDAGs long-term regional plan an ambitious. By Evan Symon October 27 2021 1150 am. Commuters travel during morning commute hours along westbound Highway 52 at Mast Blvd.

San Diegos Per-Mile Driving Tax Explained Jim Desmond. The 43 cent per-mile tax along with a two new half-cent regional sales taxes are intended to help fund SANDAGs 160 billion long-term regional plan that. Under the 163 billion proposal a four-cent-per-mile tax and two half-cent regional sales taxes were proposed for 2022 and 2028.

SANDAG expects the state to levy a tax on drivers of roughly 2 cents a mile onto which it would tack a regional 2-cent charge for a total of 4. Four cents a mile Shyronda added. Revenue from the proposed four-cent-per-mile tax would go toward the projects as would two half-cent regional sales taxes scheduled for 2022 and 2028.

The San Diego agency expects the state to levy a tax on drivers of roughly 2 cents a mile onto which it would tack a regional 2-cent charge for a total of 4 cents per mile driven. The San Diego Association of Governments SANDAG board of directors approved Oct. San Diegans debate per-mile charges for drivers.

Under the 163 billion proposal drivers would be charged a few cents for every mile they drive locally as a way to fund road and transit improvements. Under the proposal housing developers would be taxed 10000 to 22000 per mile driven by. The 43 cent per-mile tax along with a two new half-cent regional sales taxes are intended to help fund SANDAGs 160 billion long-term regional plan that.

The four-cent-per-mile tax -- and two half-cent regional sales taxes scheduled for 2022 and 2028 -- is envisioned as a way to help fund SANDAGs long-term regional plan an ambitious 30-year 160. SANDAG is still looking into how it. What the county believes is just a 2-cent addition piles up to create around 075 per mile including an existing state-level gas tax of.

San Diego County supervisors are mulling a proposal to tax housing developers based on the average miles driven by their tenants. Its a unique spin on the Vehicle Miles Traveled VMT tax that supporters say could fund transportation projects and encourage infill. SANDAG is considering a new mandate to tax drivers per miles driven causing mixed reaction.

SANDAG voted Friday to begin the public comment period for a road usage charge of four cents per mile. That could possibly be matched at the county level which could mean a total of a four-cents-a-mile fee for San Diego drivers. This fee would help pay for SANDAG.

A proposal by the San Diego Association of Governments SANDAG to institute a 4 cent per mile tax on all drivers by 2030 will be brought forward at a special public meeting on Friday. 29 a four-cent-per-mile tax proposal that could impact every driver in San Diego County by 2030. The San Diego agency expects the state to levy a tax on drivers of roughly 2 cents a mile onto which it would tack a regional 2-cent charge for a total of 4 cents per mile driven.

SAN DIEGO KGTV Dozens gathered Thursday to discuss San Diego Association of Governments SANDAG proposal to charge local drivers a 4 cents per mile tax. 27 Oct 2021 1150 am. In San Diego the concern is less on road costs and more on how to fund a 30-year 160 billion regional plan that would include things such as free public transportation and a 200 mile regional rail network costing upwards of 43 billion.

San Diego proposes a milage tax to fund a 160 billion regional plan to increase public transit usage from 34 percent to 13 percent over the next 30 years. That model says every time it gets one penny more expensive to drive a car San Diego residents will collectively drive 490000 fewer miles per weekday.

How To Calculate Per Mile Earnings Instead Of Per Hour

County City Leaders Push Back Against Proposed Mileage Tax

Consulting Business Wordpress Theme Rstheme Business Wordpress Themes Consulting Business Tax Consulting

Opinion San Diego Drivers Shouldn T Be Taxed On The Miles They Drive Times Of San Diego

Teletrac Navman Infographic Shows That The More Traffic Fatalities Happen Per Mile In The Southern And Eastern U S Fort Kent Interstate Highway Jersey City

A Helpful Tax Write Offs List For 1099 Contract Dance Teachers Special Thanks To Financialgroove Com For Providing Dance Teachers Tax Write Offs Dance Studio

Global Indirect Tax Management Market Size Share Forecast To 2025 Indirect Tax Document Management System Management

San Diego To See Major Road Improvements With California S Gas Tax Hike Gas Tax San Diego California

County City Leaders Push Back Against Proposed Mileage Tax

1954 Austin Healey 100 Austin Healey Austin Cars Austin

San Diego Driving Tax Locals Torn Over Per Mile Road Usage Tax Discussed By Sandag

Sandag Board To Discuss Controversial 4 Cent Per Mile Tax To Fund Projects Times Of San Diego

1200 Week Rental Rates For Premium Passenger Sprinter Vans Rates Include Applicable Taxes And Fees Daily 190 00 225 00 Sprinter Van Mercedes Van Van

Pin By O Gara Coach La Jolla On Lease Specials Cars For Sale Car Find Lease

Sandag Plan Board Of Directors Approves 160 Billion Transportation Plan Cuts Out Mileage Tax

Ditching The Gas Tax Switching To A Vehicle Miles Traveled Tax To Save The Highway Trust Fund

2013 Nissan Pathfinder S 2wd For 25 995 Net Cost Or 299 Lease Per Month Plus Tax Click To Find Your Pathfind 2013 Nissan Pathfinder Nissan Nissan Pathfinder

Ca Proposition 6 A Measure To Repeal Last Year S Increase To The State Gas Tax Could Be One Of The Most Consequential Issues On The November Gas Tax Gas Tax